HOW TO INVEST IN LUXURY WATCHES

With an increasing amount of watches becoming more valuable than their retail, it is almost impossible to ignore the investment aspect of certain watches. Regardless of whether you purchase watches to sell at a later date for profit or just to enjoy, watches these days have become a new source of investment. Look no further than the billionaires of China, it’s been reported that they have now shifted from investing in houses to watches which is truly shocking to see. 5 to 10 years ago this would all seem crazy and maybe even ridiculous, but as more enthusiasts and investors enter the hobby increasing the demand, prices have risen as well. Today we will go over the main watches you can invest in and how to go about selecting them.

DISCLAIMER, we are by no means financial advisors, we are just looking at historical data and summarising for you, it is entirely up to you to choose what you do with your own money.

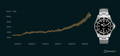

Let's start with the loudest one of them all, Rolex. I’m sure you are all aware, if you want to buy any Rolex you can think of bar a few 28mm watch models, there’s going to be a wait list and those wait lists vary in length depending on the models. Generally speaking the longer the wait list the higher the secondary market price will be and that’s because it's entitled to a higher premium to skip the long waiting lists. For example, a submariner retails around 8000 USD and can be sold at around 15,000 USD on the grey market because of how popular they are and how low the supply is for the demand.

Source : Bob’s Watches

Source : Bob’s Watches

This almost doubles its retail value so you can instantly make near a 100% increase on your investment with a submariner, this can also been seen to be the case for most Rolex sport watches and even higher for the likes of a Daytona. Of course, you don’t have to purchase all these watches at retail in order to invest in them, just like stocks or commodities within capital markets, you can buy them at a premium if you think they’ll increase over time. The harder it is to get the watch both at retail and on the grey market, the better chance you have of your investment appreciation over time.

The great watchmaking brands

With certain models from the brand selling at lucrative amounts at auction, Patek Philippe and Audemars Piguet are two very big brands within the watch community renowned for their exclusivity. With that, comes a hefty premium to purchase second hand. Again, that because of the high demand and low supply due to the length of time it takes to make one of these watches. Knowing this, you can either look to see what the value of the watch is second hand and try to find a model that is undervalued by someone who either hasn’t updated the price or isn’t aware that the price should be higher.

Source : Pinterest

From there you can buy it at a lower price and then sell it for a higher amount, however, as we have recently seen prices falling down due to the overall economy and many other factors. Choosing classic models from each brand however is always a safe bet like the nautilus or the royal oak, both highly desired and very hard to get. If you acquired one at retail you’ve instantly made a huge gain in your investment but you can always purchase second hand and hold on to it for a few years if you think it is going to increase in value.

Source : Chrono 24

One note to be very mindful of is hype, whilst hype is great for pushing prices up, they tend not to remain high for very long, which is fine if you are looking to quickly buy and sell for short term profits. However, for a more long term investment, stick to classic watches that have consistently performed well over the years and you can use web pages like Chrono24 to see the historical performance of a watch.

With more and more people entering the hobby of watches demand is not decreasing and watch makers cannot massively increase production so there is almost certainly going to be watches that always hold and gain value very well. But like mentioned at the beginning, it is entirely up to you which brand and model of watch you invest in.

There is one more way to invest in watches and that's to look at watches that have been heavily used or damaged, then fixing it either yourself or using another watchmaker and then sell it for a higher price for profit. This is just like investing in a house that is maybe a bit run down but you know that with a bit of renovation you can resell the house for a lot more. Of course, whilst this method has made people very wealthy, it takes a lot of time, skill and effort so if you’re going to do this with watches, bear that in mind!

In summary, to invest in luxury watches you need to first decide how you want to go about it, by buying brand new from retail, negotiating a cheaper price second hand to then resell for more or to find damaged watches and repair them to sell for more? You then need to focus on what brand and model you think is best, a great way to do that is by looking on Chrono24 and seeing how the price of the watches has evolved over time so you can get an idea of the level of risk you will bear by investing in that particular model. Then you can either hold on long term or try and flip short term, whichever you decide to do, always make sure you’ve done your research first to avoid making a loss! But please remember, whilst watches do retain value and have a market value therefore making them an asset to invest in, it doesn’t mean you should only do it for that reason. They were meant to be worn and loved so make sure you don’t forget that either.