WHY INVEST IN LUXURY WATCHES?

For years buying and selling a watch was just a means to free up some money tied up in your watch and you would be happy if you lost a few hundred dollars on even a Rolex. Flash forward to 2024 and we can look back and see the incredible peaks of the market caused by the infamous Covid pandemic. With Rolex, Tudor, Omega, Patek Philippe and Audemars Piguet hitting some incredible prices and it looked as though anything watch related would make you a sizable return. However, now that we have come away from these abnormal circumstances around the world and everything is settling down we can get a better idea of how watches as investments actually perform. Today we will briefly go over how you can invest in luxury watches but please be aware that this is not financial advice and you should always buy what you like.

The first thing to know about investing in watches

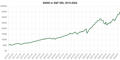

The first thing to understand when you see how much money people have made buying and selling their own watches is that it is all relative. For example, back in 2010 you could buy the Submariner 114060 no date for around 5,500 USD and in 2024 you could sell that for 10,000 USD. This is a good profit but had you invested in a general index fund like the S&P 500, you would now be sitting with around 35,000 USD in 2024. Of course, with hindsight everything looks easy but this is just to highlight that whilst watches can of course retain and indeed increase in value, they are by no means the number 1 way to make a few bucks! This is just to try and really illustrate that the value of your watch can go up and leave you with a profit but not crazy amounts, with the exception of a few rare pieces, so please always buy what you like as this is by far what will deliver you the most value!!

Source : S&P 500 Data

The SECOND thing to know about investing in watches

The second thing you will now want to pay attention to is the classic economics model, the old supply and demand relationship. This is what will largely determine how much you can make profit wise on certain watches. Take the classic Rolex Submariner or blue dial Datejust, millions of people want them but Rolex only makes a few thousand of them each year which leads to a waiting list forming.

For those wanting to ‘cut the queue’ you can buy them second-hand but for a premium price as you have not had to wait like others. However, if we take a look at the Tudor BB58, a fantastic watch with a beautiful vintage charm to it however investment wise it would not be perhaps the best.

This is because there are thousands of people who would like one and Tudor can make thousands of them so they can supply the demand. Therefore, as soon as a Tudor BB58 has been worn and shows signs of wear and tear this will have an impact on the resale price making them cheaper second-hand.

Products featured in the article

Whilst Rolex watches can see you make a decent return on your ‘investment’, you really need to go towards Patek Philippe and Audemars Piguet and even today only very few models will allow you to make many thousands off of them. This is because so many people would love one and the supply is ultra-low causing that second-hand market price to increase as the wait time is far longer than for a Rolex, you will need to pay a far bigger premium. Of course, you might see it secondhand and you can negotiate a good price, you could then go ahead and directly sell it on again for a higher price and you can pocket the difference.

Source : CH24

BUT, please be aware these prices might be high now in 2024 however there is no telling what the market will be like in a few year’s time. Many watches that have seen huge returns have been the result of significant hype causing a temporary inflation for demand and hence price therefore you need to have the right watch at the right time to sell it for a large profit. This makes it harder to earn high sums of money because timing any market is tricky enough, however if you focus on classic watches that have proven themselves to increase their value over time you can buy with more certainty.

Source : SJX

In summary, to invest in luxury watches you need to first decide how you want to go about it, by buying brand new from retail, negotiating a cheaper price second hand to then resell for more. You then need to focus on what brand and model you think is best, a great way to do that is by looking on Chrono24 and seeing how the price of the watches has evolved over time so you can get an idea of the level of risk you will bear by investing in that particular model. Then you can either hold on long term or try and flip short term, whichever you decide to do, always make sure you’ve done your research first to avoid making a loss!

But please remember, whilst watches do retain value and have a market value therefore making them an asset to invest in, it doesn’t mean you should only do it for that reason. They were meant to be worn and loved so make sure you don’t forget that either. They are not a sure way to make a lot, rather it is nice to know that you can enjoy a luxurious product but should you need to free up money you can easily do so.